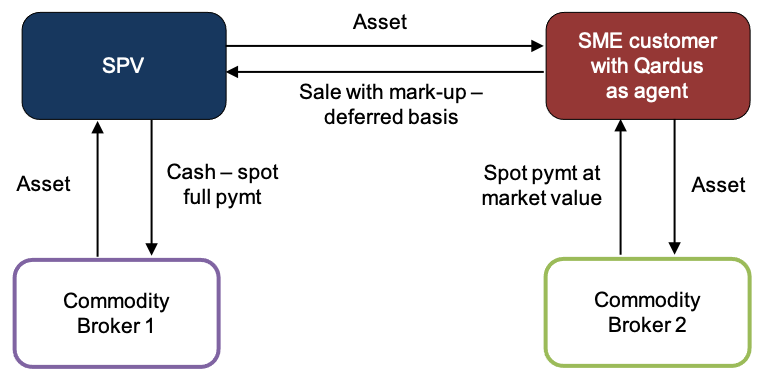

Commodity murabaha (CM) is a popular structure for Sharia-compliant working capital financing in the UK. The diagram above illustrates the steps involved in a typical CM financing transaction, on the assumption that the SME Customer is obtaining cash flow financing and requires a £100,000 facility from using the Qardus platform. The structure has been developed based on AAOIFI Sharia Standards and the steps involved are as follows:

- A special purpose vehicle (SPV) acquires non-precious metals from Broker 1 on the London Metal Exchange (LME) for value equal to the financing amount (i.e. £100,000). The ownership of the metals transfers from Broker 1 to the SPV.

- The SPV immediately sells the metals to the SME Customer at an agreed pre-disclosed mark-up of for example £110,000 (i.e. £100,000 + £10K profit), but on deferred payment terms. The full £110,000 is therefore payable by the SME Customer over an agreed term (i.e. the financing term).

- The commodity sale is documented in the transaction request and form of offer letter and acceptance of the Commodity Murabaha Agreement. The SME Customer returns to Qardus signed copies of the transaction request and offer letter and acceptance.

- The SME Customer appoints Qardus as its agent to sell those metals, on the SME Customer's behalf, for £100,000 to Broker 2 on the LME.

- This appointment is documented in the form of an instruction letter in the Commodity Murabaha Agreement.

- Broker 2 pays Qardus (in its capacity as agent for the SME Customer) £100,000 for those metals.

- Qardus remits £100,000 (less any deductions specified in the facility agreement) in cash to the SME Customer. The SME Customer has an obligation, under the terms of the facility agreement, to pay £110,000 to the SPV in instalments (i.e. the financing term).

- Qardus as the designated security agent in the Commodity Murabaha Agreement obtains, amongst other security a debenture over any property or a personal guarantee from the SME Customer.